cryptocurrency tax calculator ireland

In other words if youre making profits or losses through the disposal of your cryptocurrency whether by selling gifting or exchanging you need to pay a 33 Capital Gains Tax CGT. The nature of asset changes.

Kryptowahrung Steuerratgeber Hilfe Koinly

With the standard CGT rate of 33 the amount of tax you will have to pay will be 730 x 033 24090.

. Disposal is a tax term and is generally one of two things. Only the amount over and above 1270 is. In other words if youre making profits or losses through the disposal of your cryptocurrency whether by selling gifting or exchanging you need to pay a 33 Capital Gains Tax CGT to Revenue.

Cryptocurrencies and crypto-assets. Capital Gain 2000 - 1000 1000. See Taxation of crypto-asset transactions for guidance on the tax treatment of various transactions involving cryptocurrencies and crypto-assets.

Returns to Revenue must be shown in Euro amounts and remittances made appropriately. If you are tax resident in Ireland then you need to pay Capital Gains Tax CGT of 33 on any profit you make on the disposal of a cryptocurrency. Cryptocurrency Tax Calculator Alternatives.

The resulting number is your cost basis 10000 1000 10. Heres an example of how to calculate the cost basis of your cryptocurrency. The Result is.

Take the initial investment amount lets assume it is 1000. Enter the price for which you purchased your crypto and the price at which you sold your crypto. Returns to Revenue must be shown in Euro amounts and remittances made appropriately.

The profits will be subject to normal income tax rules ie. Therefore individuals that are trading in cryptocurrency are required to file an income tax return Form 11 or Form 12 each year and declare profits made on trading. The Taxes Owed are.

Get started JOIN COINPANDA Sign up for free Calculate your taxes in under 20 minutes. You sell the cryptocurrency for cash. Freeman Law can help with digital currencies tax planning and tax compliance.

Crypto tax guide Mining staking income Generate complete tax reports for mining staking airdrops forks and other forms of income. Use our crypto tax calculator below to determine how much. PRSI PAYE and USC Will apply at the relevant rates Up to 52 tax.

Simply copy the numbers into your annual tax return. Where emoluments payable to an employee are paid in a cryptocurrency the value of the emoluments for the purposes of calculating payroll taxes is the Euro amount attaching to the cryptocurrency at the time the payment is made to the employee. At the time of the exchange 20 of Ethereum is worth 2000.

There are no special tax rules for cryptocurrencies or crypto-assets. Check out our free and comprehensive guide to crypto taxes. In Ireland crypto investments are treated just like investments in stocks or shares.

Use our Crypto Tax Calculator. Contact us now or Schedule a consultation or call 214 984-3410 to discuss your cryptocurrency and blockchain technology concerns. Bitcoin Taxes has provided services to consumers and tax professionals since its launch in 2014.

To use this crypto tax calculator input your taxable income for 2021 before considering any crypto gains and your 2021 tax filing status. The use of this website is not to be constitute intend or to be considered tax advice financial advice legal advice or tax. This means you may owe taxes if your coins have increased in value whether youre using them as an investment or like you would cash.

Allowable Costs As well as your personal exemption you can also deduct any allowable expenses from your crypto profits before calculating how much CGT you owe. Be sure to add how long youve owned the cryptocurrency. Divide the initial investment amount with the amount of crypto purchased lets assume 1000 coins.

If you dont want to use a tax calculator for whatever reason you have. Where emoluments payable to an employee are paid in a cryptocurrency the value of the emoluments for the purposes of calculating payroll taxes is the Euro amount attaching to the cryptocurrency at the time the payment is made to the employee. The rate you pay on crypto taxes depends on your taxable income level and how long you have held the crypto.

The deadline for filing CGT is at the end of this month. Enter your income for the year. Configurable tax settings Covers NFTs DeFi DEX trading Integrates major exchanges wallets and chains start free trial 500 integrations 100k users 150M transactions Overall gain 4700021 Income 85634 Short term 994544 Long term 3619843 ETH 313847 YFI 3849790 DOT 2121 46 transactions.

Choose how long you have owned this crypto. For example you might need to pay capital gains. The capital gain in this transaction can be calculated with the cost base as 1000 Purchase price of 10 units of Bitcoin and the capital proceeds as 2000 Market value of Ethereum at the time of exchange.

However the first 1270 of your cumulative annual gains from crypto after deducting expenses and losses from crypto investments are exempt from tax. In Ireland crypto investments are treated just like investments in stocks or shares. Choose your tax status.

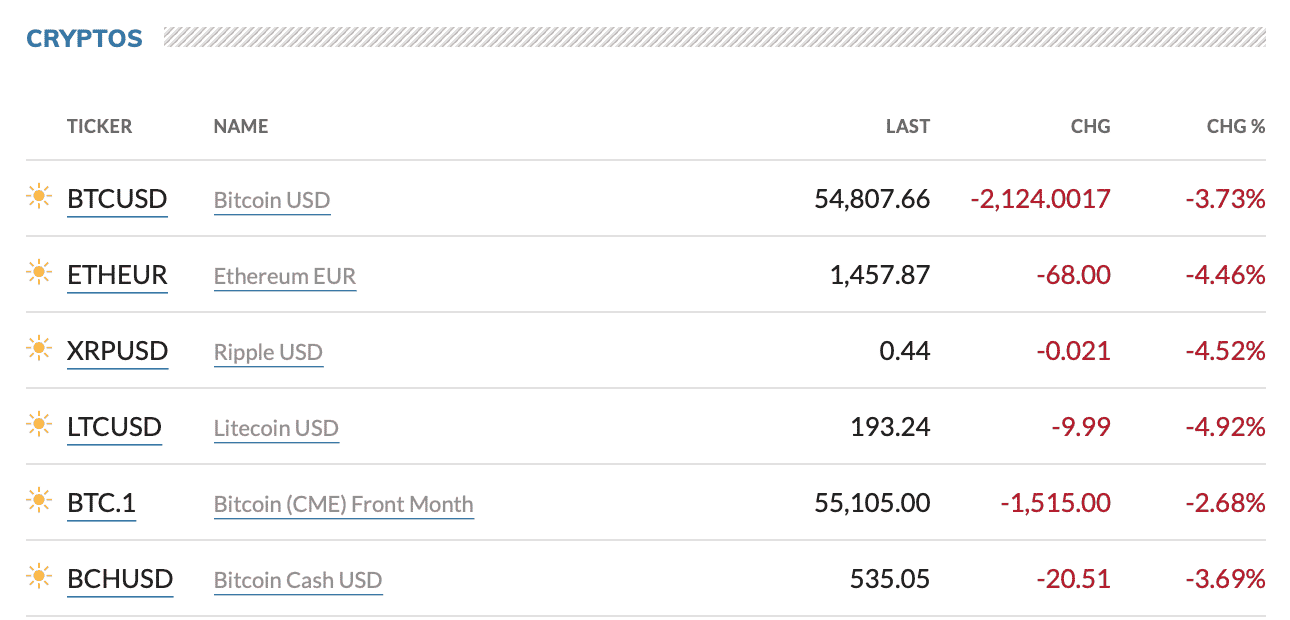

Online Crypto Tax Calculator with support for over 400 integrations. Bitcointax is the leading capital gains and income tax calculator for Bitcoin Ethereum Ripple and other digital currencies. Yes Cryptocurrency is taxed in Ireland.

Income Tax File and Pay Date. The simple answer is yes. 17 May 2022 Please rate how useful this page was to you Print this page.

If a profit or loss on a currency contract is not within trading profits it would normally be taxable as a chargeable gain or allowable as a loss for CT or CGT purposes. Gains and losses incurred on cryptocurrencies are chargeable or allowable for CGT if they accrue to an individual or for CT on chargeable gains if they accrue to a company.

La Commission Europeenne Branche Executive De L Union Europeenne Aurait Deja Enquete Sur Le Projet De Crypto Monnaie Libra De Facebo Europe L Ue Comportement

Tax On Cryptocurrency In Spain The Best Place In Eu 2021

Google Bans Cryptocurrency Mining Apps From Play Store Google Play Store Cryptocurrency App

Galaxy Digital Raises 500 Million For Business Expansion Business Expansion How To Get Rich Vietnam

322 Kim Snider Hughes How To Position Crypto Within Your Investment Portfolio Cashflow Ninja Investment Portfolio Investing Positivity

Kryptowahrung Steuerratgeber Hilfe Koinly

Cryptocurrency Tax Guides Help Koinly

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

![]()

La Commission Europeenne Branche Executive De L Union Europeenne Aurait Deja Enquete Sur Le Projet De Crypto Monnaie Libra De Facebo Europe L Ue Comportement

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

Today Marks The 2nd Anniversary Of Chinas Bitcoin Ban What Has Changed Bitcoin Cryptocurrency Capital Gains Tax

Koinly Vs Coinledger Io Ex Cryptotrader Tax Which Tax Calculator Is Better Captainaltcoin

Kryptowahrung Steuerratgeber Hilfe Koinly

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

Ireland Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Capital Gains Tax Calculator Ey Global

Koinly Blog Kryptowahrung Steuern News Strategien Tipps

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support