what is a fit deduction on paycheck

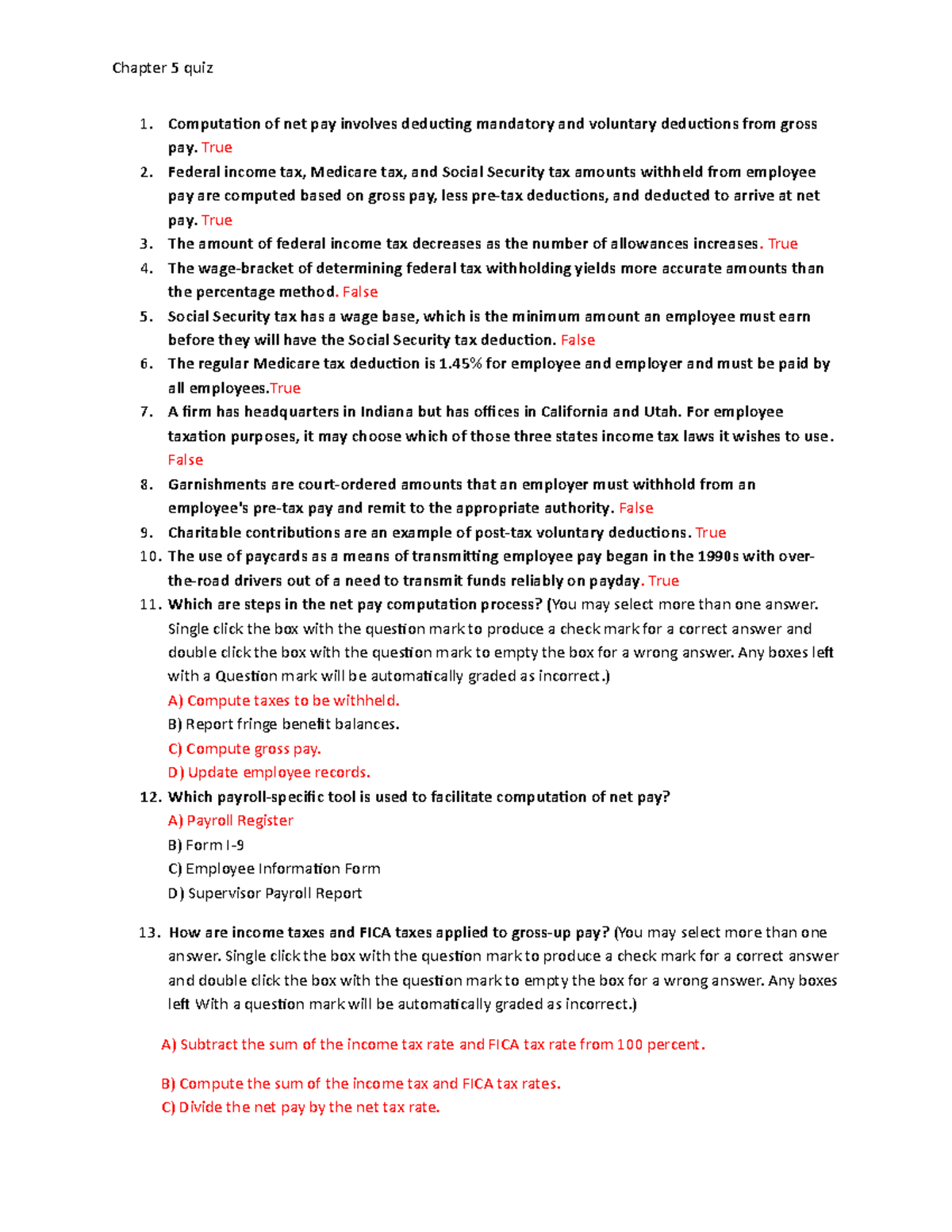

The federal income tax is a tax on annual earnings for individuals businesses and other legal entities. What is a fit deduction on paycheck.

Calculating Federal Income Tax On Form 1040 2014 Ppt Video Online Download

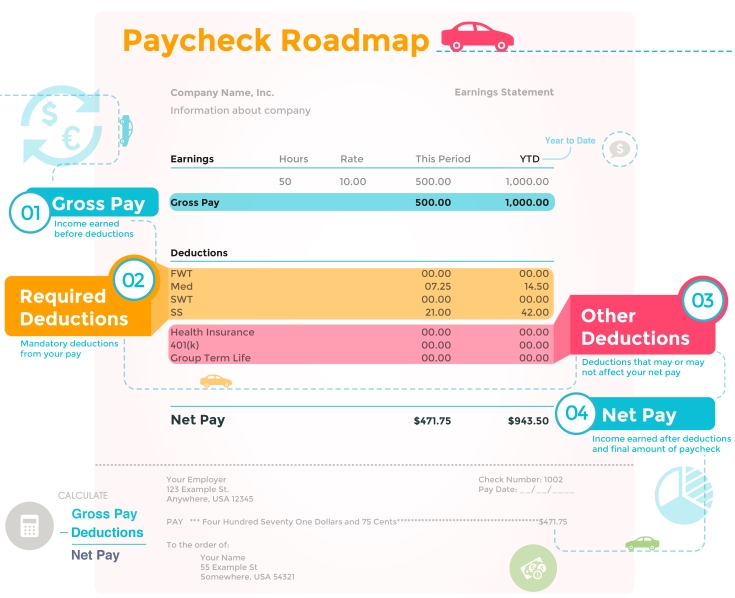

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxesFIT deductions are typically one of the largest deductions on an.

. What is the fit tax rate for 2020. 3 3PDF Deduction Gross pay State income tax SIT. A salaried employee is paid an annual salary.

You are having taxes withheld as. What it is and how it affects wages and withholding. All wages salaries cash gifts from employers business income tips.

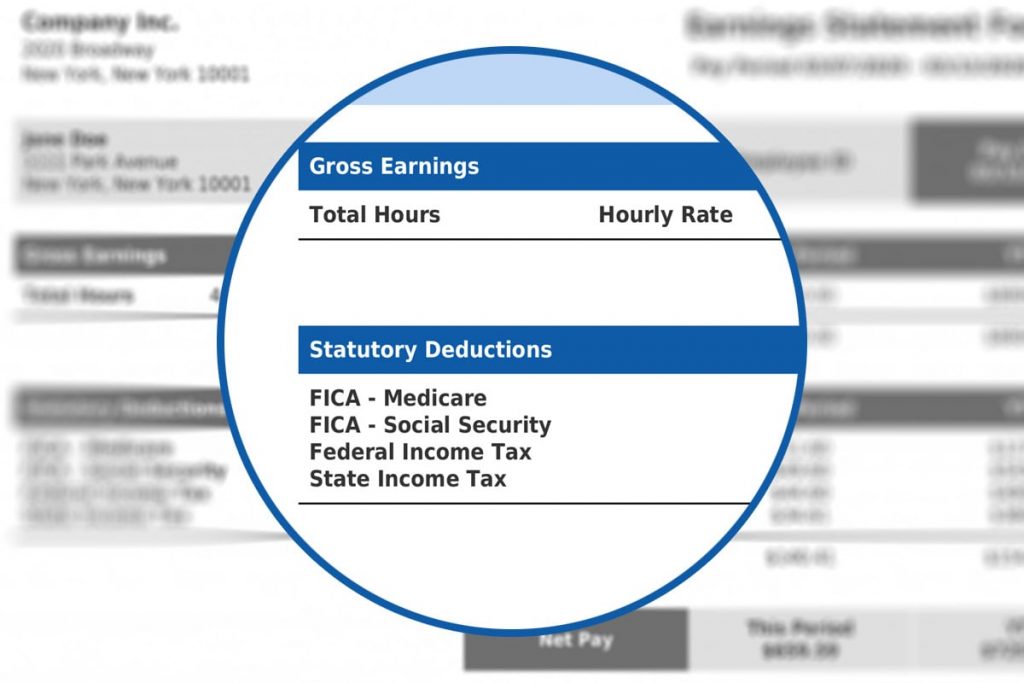

This is the information about your specific job. 2 2Federal income tax FIT withholding Gusto Help Center. TDI probably is some sort of state-level disability insurance.

The amount of FIT withholding will vary from employee to employee. FIT is the amount required by law for employers to withhold from wages to pay taxes. FITW is an abbreviation for federal income tax withholding Youll sometimes see it on payroll stubs to identify your withholding deductions.

This is your Federal and. This is your home address. There are seven federal income tax rates in 2023.

This section shows the beginning and ending dates of the payroll and the actual pay date. 1 Best answer. That annual salary is divided by the number of pay periods in the year to get the gross.

In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. For example a single employee making 500 per weekly paycheck may have 27 in federal income tax. It is your gross pay with all the.

Lets say the annual salary is 30000. The amount of income tax your employer withholds from your regular pay depends on two. Federal income tax is withheld from an employees earnings such as regular pay bonuses and commissions in addition to other types of earnings.

FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return. Withholding is one way of paying. The federal income tax rates remain.

There are a few things you should know about fit deduction on your paycheck. First fit deduction is an IRS Tax Code feature that allows you to deduct the cost of wearable. For employees withholding is the amount of federal income tax withheld from your paycheck.

May 31 2019 554 PM. Disability pay is taxable if the disability policy was paid for by your employer as an employee benefit. Payroll deductions are wages withheld from an employees total earnings for the purpose of paying taxes garnishments and benefits like health insurance.

Take a look at your pay stubany amount labeled as fica is a contribution to those two federal programs. My tax return could use such a brilliant. The FIT deduction on your paycheck represents the federal tax withholding from your gross income.

This amount is based on information provided on the employees W-4. Federal income taxes are. Net pay also referred to as take-home pay is the actual amount of compensation that is paid out via check or direct deposit to an employee.

Pre Tax Vs Post Tax Deductions What Employers Should Know

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Paycheck Calculator Online For Per Pay Period Create W 4

Chapter 5 Quiz Employee Net Pay And Pay Methods Compute Social Security And Medicare Tax Studocu

What Is Fit Tax On Paycheck All You Need To Know

Recording Payroll And Payroll Taxes In The Journal Youtube

Au Add A New Deduction Payroll Item

How Much Does Government Take From My Paycheck Federal Paycheck Deductions

How To Calculate Federal Income Tax

Payroll Archives Horton Law Pllc Management Law

Fringe Benefits Rules For 2 S Corp Shareholders Cares Act Changes

Hrpaych Yeartodate Payroll Services Washington State University

Payroll Accounting 2017 Chapter 4 Income Tax Withholding Ppt Download

What Is The Fit Deduction On My Paycheck

Understanding What S On Your Paycheck Xcelhr